The number of “Trucks” with Traffic Insurance is 475,331 and the number of “Trucks” with Insurance is 143,420.

The number of “Trucks” with Traffic Insurance is 475,331 and the number of “Trucks” with Insurance is 143,420.

In the period 2014-2022, the number of insurance coverage decreased by 1.94% and 35.59% for “truck” and “tanker”, while it increased by 85.98% for “Motorcycle and Cargo Motorcycle”.

Kasko - Teminat Adet

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2014-2022 Değişim | |

|---|---|---|---|---|---|---|---|---|---|---|

| Türkiye | 4.982.725 | 5.624.499 | 5.691.935 | 6.026.476 | 6.170.684 | 6.064.889 | 6.632.643 | 7635605,919 | 8251080,762 | 65,59% |

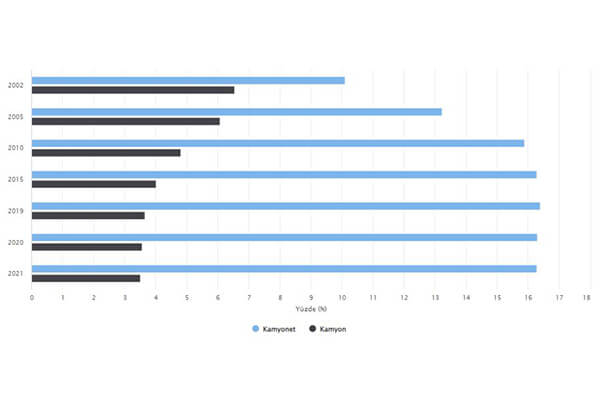

| Kamyonet | 948.623 | 992.808 | 974.508 | 1.005.435 | 997.034 | 926.586 | 1.028.175 | 1212065,146 | 1339540 | 41,21% |

| Kamyon | 146.264 | 151.298 | 144.211 | 148.815 | 142.384 | 131.779 | 133.731 | 141353,3843 | 143420 | -1,94% |

| Motosiklet ve Yük Motosikleti | 11.229 | 12.593 | 15.336 | 26.114 | 21.528 | 22.156 | 19.773 | 40966,3335 | 20883 | 85,98% |

| Tanker | 11.014 | 11.162 | 10.786 | 10.459 | 10.150 | 9.217 | 7.930 | 7488,46876 | 7094 | -35,59% |

| Çekici | 119.302 | 133.640 | 126.829 | 130.712 | 128.661 | 127.168 | 139.971 | 163362,649 | 185302 | 55,32% |

Trafik Sigortası (Yeşil Sigorta Hariç) - Teminat Adet

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2014-2022 Değişim | |

|---|---|---|---|---|---|---|---|---|---|---|

| Türkiye | 15.062.936 | 15.522.432 | 16.502.412 | 17.524.114 | 18.691.256 | 19.197.673 | 20.064.849 | 20729249 | 22169505 | 47,18% |

| Kamyonet | 2.730.079 | 2.782.531 | 2.964.434 | 3.142.225 | 3.330.600 | 3.451.271 | 3.579.881 | 3697948,9 | 3981973 | 45,86% |

| Kamyon | 388.451 | 394.103 | 393.402 | 379.418 | 397.845 | 379.099 | 380.300 | 388691,27 | 475331 | 22,37% |

| Motosiklet ve Yük Motosikleti | 1.126.335 | 1.141.744 | 996.881 | 1.064.059 | 1.086.581 | 1.090.076 | 1.188.950 | 1310329,8 | 1417020 | 25,81% |

| Tanker | 16.125 | 19.026 | 19.150 | 19.628 | 19.469 | 18.216 | 17.723 | 17227,196 | 17701 | 9,77% |

| Çekici | 211.831 | 217.677 | 213.695 | 212.179 | 229.771 | 236.319 | 251.499 | 287228,89 | 402681 | 90,10% |

Source: www.tsb.org.tr

- Guarantee: It is the assurance that the insurer undertakes to give to the insured in case of damage. (https://www.generali.com.tr/sigorta-terimleri)

- Motorcycle: Motorcycle and Cargo Motorcycle

- Compulsory traffic insurance is a type of insurance that every vehicle owner who goes to traffic is required to have. This type of insurance, regulated within the framework of the Highway Traffic Law No. 2918, covers the material and physical damages that may occur on the other party in case of any damage. “Road Motor Vehicles Compulsory Financial Liability Insurance”, or simply Compulsory Traffic Insurance, is a type of insurance that is required to be taken out in accordance with the Highway Traffic Law, and covers the damage caused to the property or life of the other party (third parties) in the event of a traffic accident, within the scope of the insurance policy. “Land Vehicle Insurance” or in short, Car Insurance; It is a type of insurance that covers the compensation of damages incurred by a vehicle as a result of events such as accident, fire, theft or attempted theft, within the policy limits. There is no obligation and in case of accident, not the other party; Car Insurance, which covers the damages of the vehicle to which it belongs, covers some or all of the damage according to the rules of the policy.